In 2025, Canadian nutraceutical and functional beverage brands aren’t just looking for new botanicals; they’re looking for proof.

The market’s growth story tells you why. According to Grand View Research (2024), the North American botanical extract market surpassed USD 9.6 billion in 2023 and is projected to grow at 7.2% CAGR through 2030, with Canada contributing nearly 12% of regional imports. But while volume is climbing, import scrutiny is tightening.

That’s why sourcing teams are turning toward CFIA-compliant botanicals like Macela Leaf Extract Powder (Achyrocline satureioides) , a once-quiet extract now positioned as a documentation-ready, formulation-friendly ingredient for Canada’s clean-label future.

The Compliance-Driven Shift in Canadian Procurement

For Canadian importers, the question isn’t “Is it organic?” anymore. It’s “Is it COR-certified and CFIA-ready?”

With stricter post-COVID inspection regimes, shipments without validated documentation now face average port delays of 10–18 days (CFIA Import Data 2024). Every delay costs formulators shelf time and production momentum.

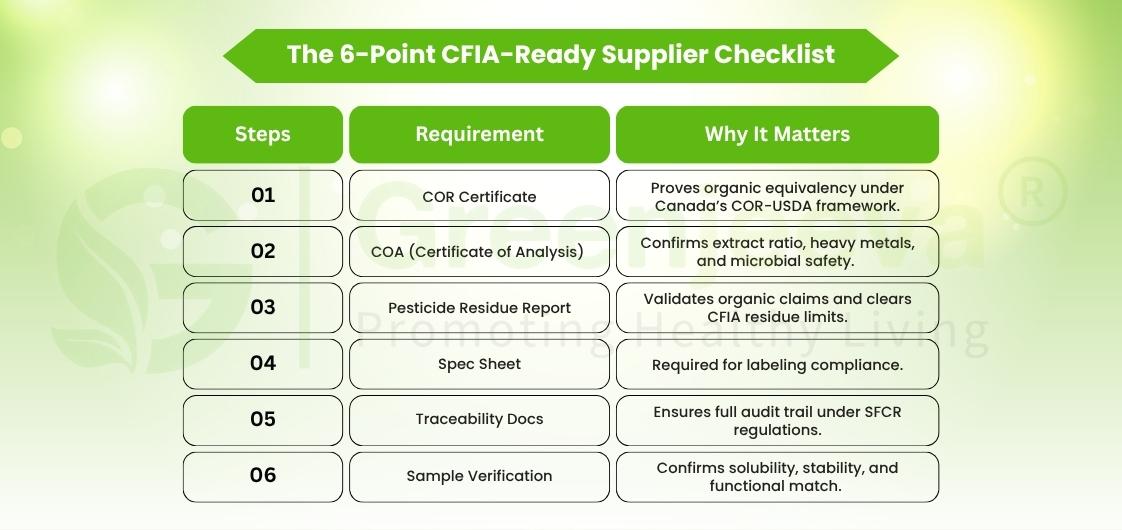

That’s why bulk Macela leaf extract powder suppliers in Canada are re-engineering their supply process around paperwork excellence:

– COR Certificate → validates organic equivalency under Canada’s COR-USDA agreement.

– COA (Certificate of Analysis) → verifies extract ratio (4:1 or 10:1), heavy-metal ppm, and microbial safety.

– Pesticide Residue Report → confirms organic integrity beyond marketing claims.

– Spec Sheet & Allergen Statement → labeling compliance for CFIA.

– Traceability Data → links batch → processing → document trail.

Why Canadian Buyers Are Suddenly Asking for Macela

The demand curve is subtle but real. Mintel Canada (2025) reports that 58% of Canadian supplement buyers now prefer products featuring lesser-known but well-documented botanicals over mass-market herbs.

For R&D teams, Macela checks the boxes that matter:

– Consistent solubility in functional beverages and capsules.

– Stable color and aroma across batch lots.

– Non-GMO and BSE/TSE-free status for global exports.

– Immediate COR + COA availability for audit readiness.

In short: it’s not the trendiest botanical, but it’s the easiest to clear through customs.

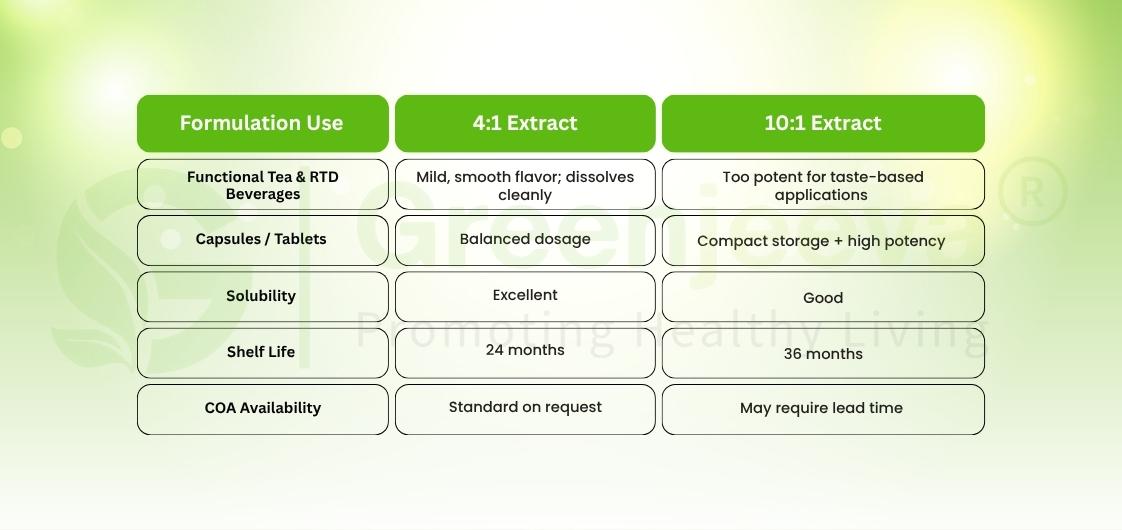

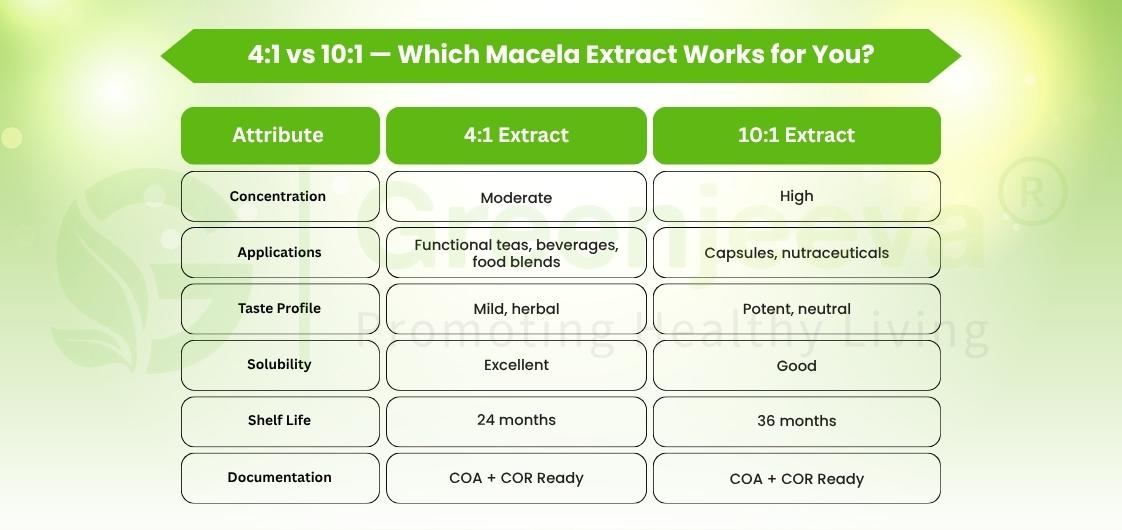

Understanding the Extract Ratios: 4:1 vs 10:1

When you source from a Macela extract powder supplier in Canada, you’ll often choose between 4:1 and 10:1 extracts, and that ratio matters.

For formulation leads, it’s the perfect dual-sourcing model: one extract for sensory trials, another for production efficiency.

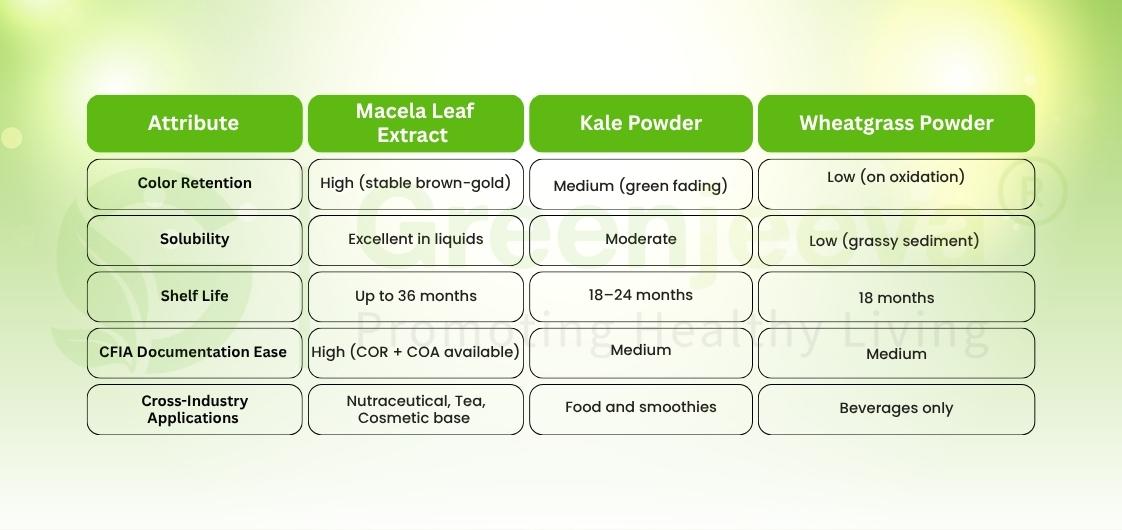

Macela vs Kale vs Wheatgrass – Which Green Performs Better for Canada?

In Canada’s green-ingredient segment, innovation often comes down to one question: Which powder delivers the cleanest label with the least friction?

Spinach, kale, and wheatgrass dominate visibility, but Macela’s documentation advantage and functional neutrality make it the new green of choice for Canadian buyers who balance creativity with compliance.

Market Momentum: Data Speaks for Itself

– The Canadian organic ingredient import market hit CAD 1.9 billion in 2024, up 13.5% YoY (Statistics Canada Trade Report 2025).

– Clean-label product launches containing botanicals grew 22% between 2022–2024 (Innova Market Insights).

– CFIA non-compliance rejections for herbal imports dropped 31% for suppliers with pre-cleared COR certificates (CFIA Compliance Bulletin Q1 2025).

The data is clear: compliance doesn’t just protect, it accelerates.

What CFIA-Compliant Buyers Check Before Approval

– Moisture Content < 10% → Guarantees microbial control.

– Heavy Metals ≤ 10 ppm → Aligned with USP & CFIA limits.

– Microbial Load ≤ 10,000 cfu/g → Hygienic processing proof.

– E. coli / Salmonella: Negative → Mandatory for import clearance.

– Batch-Level Traceability Docs → Required under SFCR Part 4.

– COR Certificate + COA Bundle → The “gold pass” for audits.

These six lines decide whether a lot clears customs or sits in storage.

For Canadian Procurement & R&D Teams: Why Documentation Is Now a Differentiator

The Canadian market rewards readiness. Brands that once lost weeks waiting for updated pesticide or COR files now insist on supplier portals with instant downloads.

When a Macela extract wholesale supplier in Canada provides COA and COR access upfront, they’re not just compliant , they’re collaborative.

This shift is giving rise to a new metric across procurement dashboards:

Documentation Turnaround Time (DTT) , the average hours between a buyer’s request and the supplier’s proof.

Top-tier suppliers clock under 12 hours. Everyone else lags.

Beyond Compliance: Sustainability and Transparency

The Canadian clean-label audience values traceable sourcing almost as much as carbon reduction. GlobeScan Canada (2024) found that 72% of B2B buyers prefer suppliers who disclose environmental and ethical data in addition to CFIA paperwork.

That’s where Macela extract bulk suppliers in Canada can stand out: by adding sustainability metrics , water usage, waste management, packaging footprint, alongside their COA sets.

Because in 2025, green means both botanical and ethical.

The Takeaway: Proof Over Promise

In Canada’s ingredient market, innovation is no longer about what you say your product can do , it’s about what your paperwork proves it already does.

Macela Leaf Extract Powder represents this new standard: compliant, versatile, and ready for the next formulation cycle.

Request Documentation → Get COR + COA

Request a Sample → Validate solubility and batch consistency

Because in Canada’s clean-label economy, compliance isn’t the last step of innovation , it’s the first.

**The Food and Drug Administration has not evaluated these statements. This product is not intended to diagnose, treat, cure, or prevent any disease.**