For years, Organic Tart Cherry Powder sat quietly in the “easy ingredients” category.

It was a fruit powder. It looked familiar. It checked the organic box. Most teams treated it as interchangeable from one supplier to the next.

That assumption no longer holds.

As clean-label formulations accelerate across nutraceuticals, functional beverages, bakery, and even cosmetics, tart cherry powder has moved from a secondary inclusion to a high-exposure ingredient—one that can disrupt formulation performance, stall regulatory approvals, and tighten supply chains when buyers least expect it.

What has changed isn’t the fruit.

It’s the market pressure around it.

Rising demand. Fragmented sourcing. Variable processing routes. Tighter organic compliance. And increasing scrutiny from QA and regulatory teams who no longer accept “fruit powder” at face value.

For bulk buyers, Organic Tart Cherry Powder is no longer about flavor or color alone. It is about risk control, documentation defensibility, and formulation predictability at scale.

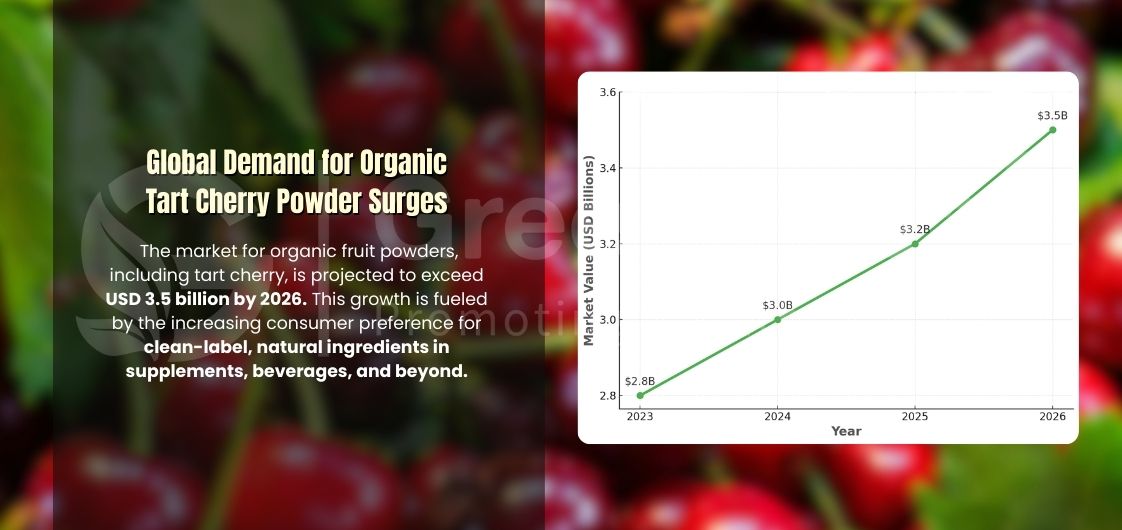

The Demand Surge That Exposed the System

Across North America, tart cherry powder now appears in more products than ever before. Functional beverages use it for natural color and acidity balance. Supplement brands rely on it as a recognizable fruit component. Bakery and bar manufacturers use it to replace artificial colors. Personal care brands explore it for pigment and exfoliation applications.

But as demand climbs, supply fragility becomes visible.

Sour cherry production is regionally concentrated and seasonally volatile. In Canada, commercial volumes are largely centered in Ontario, and year-to-year yields fluctuate significantly. When local supply tightens, procurement teams turn to imports—often without fully requalifying processing methods or documentation standards.

This is where buyers begin to feel the shock.

Suddenly, powders that were “fine last year” behave differently. Colors appear duller. Solubility changes. Sweetness varies. COAs don’t align with incoming batches. What used to be a plug-and-play ingredient becomes a formulation variable.

And at scale, variables are expensive.

Processing Choices: The Decision That Shapes Everything Downstream

One of the most misunderstood realities of Organic Tart Cherry Powder is how dramatically processing method determines performance.

Freeze-dried powders retain more whole-fruit characteristics. They deliver deeper pigmentation, higher fiber content, and a more “authentic” fruit profile. But they also introduce challenges—larger particle size, higher hygroscopicity, and a particulate mouthfeel that can complicate beverage or capsule applications.

Spray-dried powders, on the other hand, behave very differently. Derived from juice or concentrate, they tend to dissolve more easily, show smoother sensory profiles, and scale well in beverage or supplement manufacturing. Yet they often rely on carriers such as maltodextrin, rice powder, or tapioca dextrin, which immediately changes label declarations and clean-label positioning.

When buyers fail to lock down processing expectations contractually, the consequences surface late—after pilot trials, after packaging approvals, or worse, after production runs.

Market shock doesn’t come from bad ingredients.

It comes from poorly defined ones.

Why “Clean Label” Becomes a Procurement Liability Without Precision

In theory, Organic Tart Cherry Powder supports clean-label positioning. In practice, that claim collapses quickly without transparency.

Not all organic powders are single-ingredient. Not all carriers are acceptable across markets. Not all organic certificates support identical labeling rights under different regimes.

For Canadian buyers, this is especially critical. Products wishing to display the Canada organic logo must meet strict content thresholds and documentation requirements. Imported organic powders relying on USDA certification must carry equivalency attestations and properly reference the final handler.

Procurement teams that overlook this nuance risk rework at the packaging stage—or worse, regulatory pushback after launch.

The market has matured.

Regulators have caught up.

And buyers who treat organic verification as paperwork rather than strategy are the ones absorbing the cost.

Formulation Reality: Tart Cherry Powder Is Not Passive

From an R&D standpoint, tart cherry powder is often underestimated. It is not just a colorant or flavor contributor; it is chemically active within formulations.

Anthocyanins drive pigmentation, but they are sensitive to pH, heat, and oxygen exposure. Natural sugars affect browning and Maillard reactions in baked or cooked applications. Fiber content alters texture and binding in bars and dry blends. Residual moisture influences caking and shelf stability.

This means that formulation behavior can change between lots—even when the ingredient name remains the same.

Experienced manufacturers understand this and demand more than a basic COA. They ask for particle size distribution, bulk density, water activity, and solubility behavior under application-specific conditions. Without this data, scale-up becomes guesswork—and guesswork leads to delays, rejects, and lost margin.

Documentation Is Now the First Gate — Not the Last

One of the sharpest market shifts is where failures occur.

Historically, issues surfaced during production.

Today, they surface during documentation review.

QA teams reject COAs that lack batch specificity. Regulatory managers flag mismatched organic certificates. Import documentation stalls shipments because certificates reference outdated handlers. What once cleared quietly now demands justification.

This is not bureaucracy—it is risk management catching up to market volume.

Bulk buyers have learned that documentation quality is often the fastest indicator of supplier reliability. Suppliers who control traceability from orchard to powder, maintain current certificates, and support retained sample testing are the ones who withstand scrutiny as volumes grow.

In contrast, suppliers who treat documentation as an afterthought rarely survive long-term supplier qualification.

Market Pressure Turns a Fruit Powder into a Strategic Input

Tart cherry powder now sits in a category shared with other “high-attention” ingredients: turmeric, ginger, psyllium, inulin, and botanical extracts. They are familiar, but no longer forgiving.

As volumes scale, the cost of inconsistency multiplies. One rejected lot can stall multiple SKUs. One unverified ingredient can ripple across supply chains. One unclear specification can force last-minute reformulation.

The smartest procurement teams adapt by changing posture. They stop asking, “Who has tart cherry powder?” and start asking, “Who understands how tart cherry powder behaves, documents it properly, and can support consistency when demand spikes?”

That shift—from buying ingredients to qualifying systems—is where competitive advantage forms.

What Winning Buyers Are Doing Differently

Across North America, experienced sourcing teams now treat Organic Tart Cherry Powder as a controlled raw material rather than a commodity.

They qualify more than one processing route. They define acceptable carriers in advance. They require documentation that aligns with destination markets—not just origin markets. They test at pilot scale before committing to volume. And they plan for supply variability instead of reacting to it.

Most importantly, they accept a hard truth of today’s market:

Stability is no longer cheap. But instability is far more expensive.

Conclusion: The Market Has Changed — and Tart Cherry Powder Changed With It

Organic Tart Cherry Powder is still a valuable, versatile ingredient. But its role in modern formulations has evolved. What once felt safe by default now demands precision, transparency, and foresight.

For bulk buyers, especially those operating in regulated, clean-label markets, tart cherry powder is no longer just a fruit inclusion. It is a supply chain decision, a documentation test, and a formulation variable rolled into one.

In a market defined by speed, scrutiny, and scale, the brands that thrive will be the ones that stop sourcing ingredients reactively—and start sourcing reliability.